|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 30 Year Refinance Rates NJ and Their Impact on HomeownersIntroduction to 30 Year Refinance RatesRefinancing a mortgage is a crucial financial decision for many homeowners in New Jersey. It involves replacing an existing loan with a new one, often with a different interest rate and term. The 30-year refinance rate is one of the most popular options, providing stability and predictability over a long period. Understanding these rates can significantly impact your financial planning. Factors Influencing 30 Year Refinance RatesEconomic IndicatorsSeveral economic factors can influence refinance rates, including inflation, employment rates, and the Federal Reserve's monetary policies. Keeping an eye on these indicators can help you time your refinance for the best rate. Credit ScoreYour credit score plays a vital role in determining the refinance rate you're offered. A higher score typically leads to a lower interest rate, making it important to maintain good credit health.

Common Mistakes to Avoid When RefinancingOverlooking FeesOne common mistake is neglecting to consider the associated fees with refinancing, such as closing costs and application fees. These can add up and offset the benefits of a lower rate. Ignoring Loan TermsWhile a lower interest rate is attractive, it's crucial not to overlook other loan terms. Some might find a fixed rate mortgage loan more beneficial depending on their financial situation. Not Shopping AroundFailing to compare offers from different lenders can result in missing out on better rates. Take the time to research and negotiate the best possible deal. Benefits of Refinancing Your HomeRefinancing can offer several advantages, such as reducing monthly payments, shortening the loan term, or converting an adjustable-rate mortgage to a fixed-rate one.

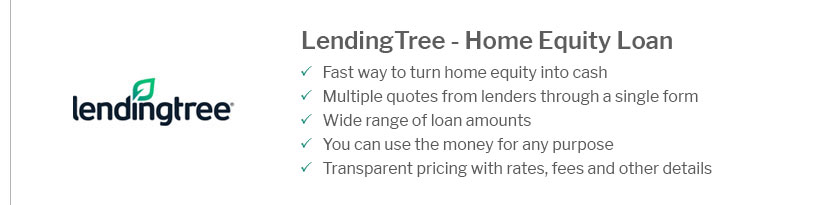

For instance, some homeowners utilize refinancing to access equity for significant expenses, leveraging options like the texas lending home equity loan to fund renovations or consolidate debt. Frequently Asked Questions

https://www.bankrate.com/mortgages/mortgage-rates/new-jersey/

Current mortgage rates in New Jersey. As of Thursday, March 20, 2025, current interest rates in New Jersey are 0.00% for a 30-year fixed mortgage and ... https://www.usbank.com/home-loans/mortgage/mortgage-rates/new-jersey.html

... rates for a variety of refinancing options. See refinance rates. Today's 30-year fixed mortgage rates. 6.375% Rate. 6.551% APR. Learn how these rates and APRs ... https://www.nerdwallet.com/mortgages/mortgage-rates/new-jersey

Today's mortgage rates in New Jersey are 6.772% for a 30-year fixed, 5.981% for a 15-year fixed, and 7.097% for a 5-year adjustable-rate mortgage (ARM). Check ...

|

|---|